The fintech industry reigns supreme in the IT startup economy, and digital banks seem to reign supreme in fintech. Traditional banking is a bureaucratically painful experience, so it’s not strange that user-friendly smartphone-centered banks are booming all over the world. A bright example is Monzo – a well-rounded, rapidly-growing digital bank from the UK, equipped with the most demanded features. Such applications as Monzo are intricate pieces of tech created with security and intuitiveness in mind with the help of cutting-edge tools. Nevertheless, developing a digital bank similar to Monzo is not an unimaginably difficult feat as long as you have the required knowledge and the backup of a software-savvy team.

This article will provide you with the fundamental knowledge of neobanks and describe how to build an app like Monzo.

Content:

1. Digital Banking App and Its Functions

2. Benefits of Developing a Banking App Like Monzo or Similar

3. Problems You Can Face in Creating a Monzo-like Banking App

4. How to Make a Banking App Like Monzo in 3 Steps

6. Conclusion

Digital Banking App and its Functions

There are a bunch of names used to describe banking apps like Monzo or Revolut: neobank, app-based bank, digital bank, online bank, mobile bank. Putting the semantics aside, what is a digital bank? Regardless of the chosen name, a digital bank is a bank that allows users to conduct financial operations online via an app or website.

Unlike their traditional counterparts, digital banks do not have physical locations as those are undemanded and simply unnecessary expenses. The biggest appeal of such banks is the possibility to conduct financial operations by simply pressing several buttons on your screen; no need to go to a bank and fill in dozens of different documents.

What about the digital bank’s functionality? The best way to explore the services a digital bank provides is to choose a bright example and research it. There are a plethora of digital banking apps to choose from. We decided on Monzo because of its success, universality, and overall power of the UK fintech sector. The fact that Monzo achieved success in the dense UK market regardless of the harsh competition is proof of the bank’s relevance.

Thus, Besides obvious currency accounts and spending notifications, Monzo has the following useful functionality and features:

1) Sending money to other Monzo accounts in a few taps.

2) Splitting bills easily. With Monzo, there are no more hustle splitting bills with your friends at a cafe or paying for something. The app will help to figure out how much each one should pay.

3) Shared tabs help to keep track of who paid for what and how much to monitor debts.

4) Early payments. If a person receives payments into Monzo, the digital bank ensures that he or she will be paid a day early compared to traditional banks.

5) Salary sorter. After receiving a payment, a user can split it into separate accounts, for example, savings and bills.

6) Pay with Monzo on ApplePay.

7) Setting spending budgets. A user can set specific budgets (eating, entertainment, etc) to monitor and control their spending.

8) Fee-free cash withdrawal in the European Economic Area.

9) Spare-change saver. A round-up option that rounds a user’s purchase up to the nearest pound and gives a difference to the user.

10) A saving pot allows adding interest rates to a user’s budget (up to 1.54%).

11) Fast customer support per request.

12) A user can set a joint account with another Monzo user.

13) Loans. Monzo can provide up to a £15,000 loan.

14) Set up overdraft limits and get charged accordingly up to £15.50 per month if overdrawn.

15) History of purchases.

Besides the mentioned functionality, Monzo provides a lot of tiny but pleasant customization features, such as Monzo icon options, adding images to Pots, etc.

Benefits of Developing a Banking App Like Monzo or Similar

There is no objecting that a decision to make an app like Monzo is a huge time- and frustration-saver for potential users considering the overall convenience of the digital banks. Let’s name a few benefits of Monzo-like apps and why people enjoy using them:

- Easy to start

- Convenient budgeting tool

- Great savings-management tool

- Spending in the EEA zone without fees

- Possibility to get loans and set overdraft limits

- Earn interest on savings

- Customize banking experience

From a business perspective, creating apps like Monzo is a lengthy and complicated but potentially extremely rewarding project. The fintech sector alone is an attractive and profitable industry. In 2018, fintech had $111.8 billion in investments, according to the KPMG report. As for the industry’s future, the UK, with its rapidly growing fintech sector, is a bright example of the possible trends.

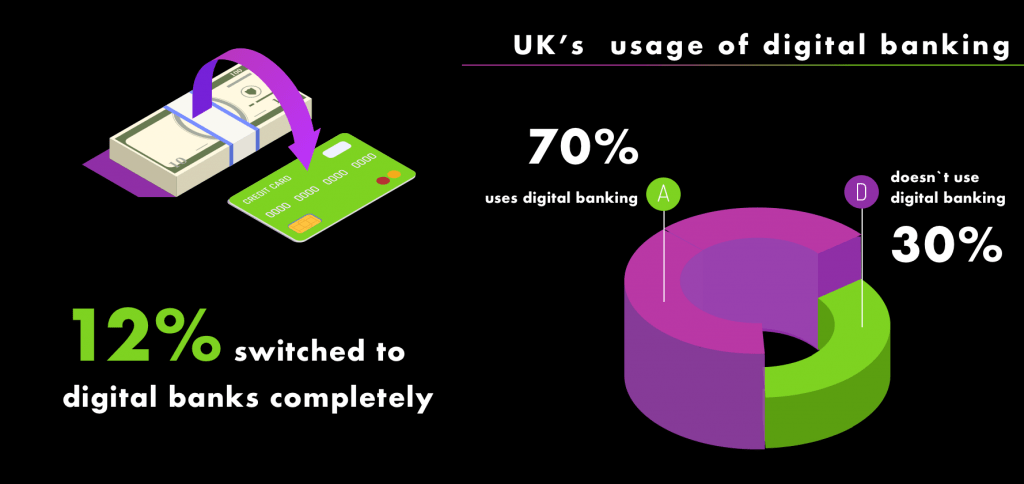

Currently, up to 70% of the UK’s population uses digital banking while 12% switched to digital banks completely, and ⅔ of the population want to follow their example according to Finder’s statistics. In addition, the UK neobanks expect to triple the number of their customers in the following year. The UK’s example demonstrates amazing opportunities for digital banks to seize, while Deloitte’s research predicts 3 billion digital bank users globally by 2021.

The global market’s opportunities are ripe for harvesting; you just need to need a relevant product, follow the urge to start an online bank like Monzo, to do it.

Problems You Can Face in Creating a Monzo-like Banking App

Despite the ripeness of the global market, an entrepreneur shouldn’t go in blind without exploring its ocean floor and caveats. Making a Monzo-like bank is a complicated and multi-faceted enterprise with a lot of apparent and not-so-apparent challenges.

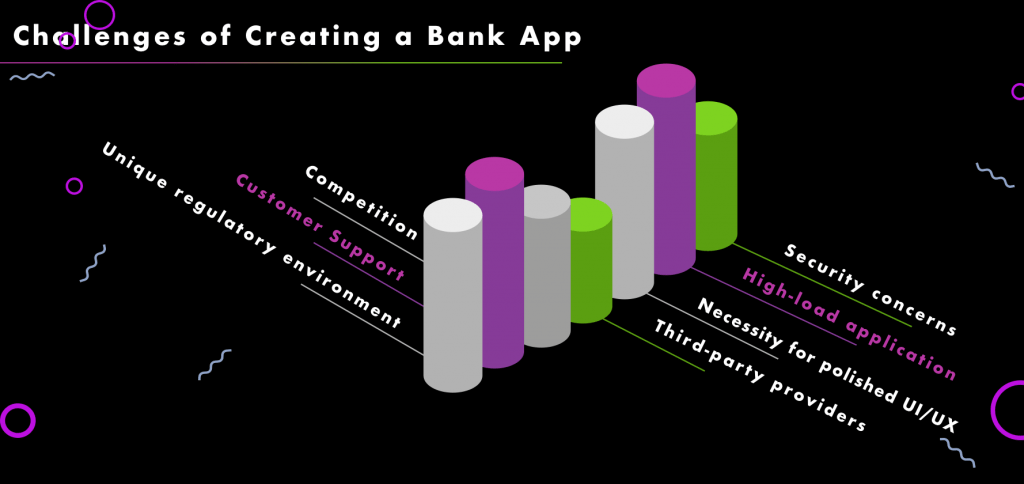

Thus the challenges of creating a digital bank app are:

1) Unique regulatory environment within which the digital bank will operate. Depending on the country, there are different regulations with unique features neobanks should adhere to. For instance, the UK has an Open Bank initiative and the EU — GDPR.

2) Security concerns. Security is the alpha and omega of a neobank, and ensuring high-security standards is quite a challenge that requires an experienced development team.

3) High-load application. A banking app will potentially deal with millions of requests on a daily basis. Creating an app that can easily deal with such a load requires special expertise.

4) Necessity for polished UI/UX. For people to choose your digital bank, the latter should have a great and intuitive design.

5) Third-party providers. A neobank will have to rely on third-party providers to conduct some of its operations. For instance, Monzo partners with Mastercard, Amazon Web Services, and Intercom. Finding the best providers and establishing great relations can be challenging. It also raises new security concerns.

6) Competition. There are quite a few willing to try their hand at digital banking. However, with a properly polished idea, a well-executed development, and a nice marketing team, you will have everything required for overcoming competition.

7) Customer Support. Ideally, a banking app should have customer support from the start. Without it, you will have a bunch of frustrated and angry customers from the very first days of the neobank’s activity. You can consider AI assistants powered by GPT to resolve this problem. It provides a quick, personalized, and human-like service to build strong customer relationships that propel your business growth and help maximize revenue potential.

Overall, the levels of the back end, front end, UI/UX, BA, and regulatory knowledge and experience required to create a successful digital bank app are quite high.

How to Make a Banking App Like Monzo in 3 Steps

So, now you are well aware of the fintech market and digital banks’ potential as well as challenges associated with developing a neobank app. And, you are ready to enter the game yourself and create an app like Monzo. The next question you are presented with: “what is the process of developing a digital bank like Monzo?”

Stage 0: Discovery Phase (optional but desirable)

If you have a rough idea/vision of a banking app to develop but you didn’t conduct an analysis of the market and competitors to determine exact functionality, accurate blueprints of the future system, and UI/UX mockups, the Discovery phase is what you need. In addition, the discovery stage will provide you with the cost estimates for developing a complete product.

Thus, depending on the chosen package, as a result of the discovery phase, you will have the following:

– product concept from the Product Manager

– prototypes from Business Analyst

– a visual concept from UI/UX Designer

– an architecture concept from System Architect

– price for the development of the product

Now, you own a solid foundation upon which the relevant digital banking app can be built.

Stage 1: Development

The development process will be split into iterations called sprints, during which the parts of the functionality will be developed and tested. Roughly, the structure of each sprint is the following:

- Planning

- Design

- Development

- QA phase

- Review

Throughout the development process, a project manager will communicate with you to keep you updated on the progress, consider your feedback, answer your questions, and simply will be responsible for your inner peace regarding the smoothness of your digital bank’s construction.

You can speed up this process by choosing a white label fintech solution. With a wide range of pre-built features, combined with thoughtful customization and development, you receive a solution with the functionality to jumpstart your online finance business or get digital without heavy upfront investment.

Stage 2: Deployment, Further Maintenance & Support

After the primary development is over, it is time to deploy the product to the market and brace for the influx of customers. It’s a vital stage that will demonstrate the robustness of the digital bank and can uncover hidden weaknesses that will have to be dealt with quickly.

Software that does not evolve fades into obscurity. Therefore, it will be important to update the digital bank you developed so it stays relevant and suits the latest trends. The support & maintenance phase of a successful product lasts for as long as the product stays in the market.

A note about the price of Digital Bank Development

If you only have a rough idea, the best way of determining a price is to conduct a discovery phase. Otherwise, the experts can analyze your requirements and provide you with cost estimates. It is worth mentioning, though, that there are different contracts concerning software development to choose from.

Nonetheless, developing a Monzo-like digital bank is a complex and lengthy process. However, you don’t need to break the bank to develop a digital bank. The iterative nature of software development allows splitting the product into smaller chunks, which can be launched and promoted to accumulate customers and attract investors. For instance, the results of the discovery phase alone can be used to interest investors and raise additional funding. We already have had the clients whom we helped to raise millions of investments (read here about CellSavers/Pulse if you want to know more).

If you want to read more on the latest investment trends and practices, we suggest you read articles from SeedLegals; they’re a real gem.

Security of a Banking App

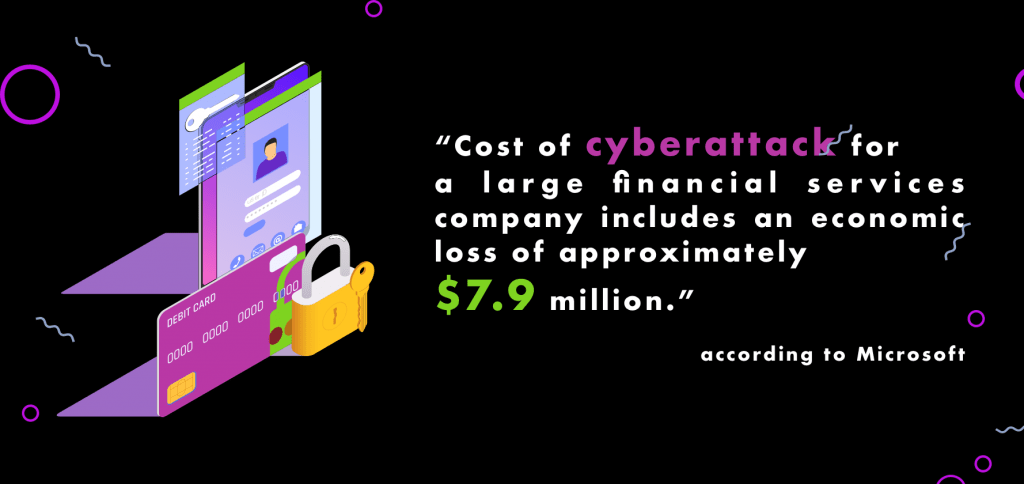

There is no need to emphasize the importance of a banking app’s security considering the fact that the app deals with money. It is worth mentioning though that according to Microsoft, “the cost of a cyberattack for a large financial services company includes an economic loss of approximately $7.9 million.”

Previously, we wrote an article on ways to ensure a fintech app’s security. Its key points apply to digital banks as well. These are the ways of achieving a digital bank app’s quality security:

- Develop reliable system architecture

- Write reliable code with reliable project logic.

- Conduct a thorough quality assurance (QA) phase

- Add multi-factor authentication

- Use end-to-end encryption

- Use secured web access

- Implement real-time notifications and alerts

- Encourage safety practices among the customers

An experienced team of developers can cover almost all of the mentioned points and make an online bank app that is secure and robust. We also want to stress that a proper QA phase is particularly important as it determines the majority of weak points during different iterations of software development. There is no avoiding bugs and weaknesses, but QA can help eliminate most, if not all, of them.

Conclusion

Fintech in general, and smartphone-centered digital banks like Monzo in particular, are a lucrative and promising niche. There are a lot of opportunities for entrepreneurs who want to try their hand at conquering their share of the market.

Developing popular online banking apps like Monzo is a feat of software and business prowess. However, you should not make it on your own. We can help. KindGeek has all the software and business expertise required to create a neobank app that will be competitive and appealing. We already had experience working with major fintech players, digital banks, and startups, developing software for their products.

If you are interested in our possible partnership or want to build an online banking app, contact us. We’ll be happy to make your vision a reality. We also provide a white label digital banking platform, which serves as a foundation for digital finance products. The customizable white-label core allows you to build on top of it and create a unique customer experience. No need to start from scratch – go to market quickly and cost-effectively.