You may face a lot of interesting challenges and discoveries while starting a new project in a new country. One of those was for us a banking project from Nigeria. And one more experience that reminds us of all the necessity of the discovery phase.

So we gonna have a little talk about Kindgeek’s experience with financial services. The first question will be: “how to choose the ‘right’ money transfer service?”, and definitely not the last. So, we decided to share some conclusions of our discovery.

Remittance to major receiving countries of Africa has fallen for the last year, including Bangladesh (-11.1 percent), Nigeria (-10 percent), and Egypt (-9.5 percent).

And that’s not because there are no people who want to send money abroad. The reason is that sending money abroad is usually unreachable and always disturbs us as a difficult process with a lot of documentation.

So how do find the best payment service provider to send money to another country?

Our main object was Nigeria.

While developing a project related to financial systems, there are major factors to process:

1. Secure transfer services are big and reliable services such as Western Union and Money Gram.

For example, Western Union one of the most reliable and oldest financial services uses such policies and procedures as photo identification and tracking number (MTCN) verification to make sure money’s sent to the right person.

2. Cost of transactions depends on the transaction fee and exchange rate.

All banks and money providers have different fee structures, and they all take different margins on the daily exchange rate. Depending on the size of your transfer, you can save hundreds of dollars by comparison before you send money to your bank.

So pay attention to what service you want to choose and remember all the next lessons learned :

- Money transfer fees can vary greatly depending on your provider

- Watch out for the margin on the exchange rate

- Your recipient may also be charged to receive foreign payments (many banks charge their customers between $15 and $30 to receive international transfers)

- There are a minimum and a maximum amount of money to send per transaction, day, week or month, or year.

3. Time

- If you make direct bank payment it can take up to 3-5 days due to work with banks

- If you send it to the bank account it can take 1-2 days

- If you send money to a credit/debit card it can be done in minutes but expensive.

4. API availability

If you’re involved with integration, you have to be well-versed with application program interfaces (APIs), which are tools that make it possible to manage software applications. A startup, for example, may want to open its API, as doing so encourages third parties to use its software.

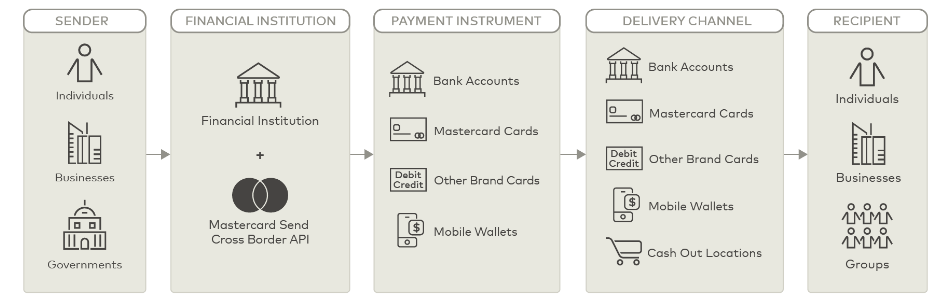

5. Different channels to send money

Additionally, there are different payment sending channels, delivery channels, and payment instruments that we can use to send money.

6. Legislation and regulations. In spite of what you want to develop, you have to do it by the rules of the financial world

The primary financial institution for the regulation of banks is the National Bank of a country that is empowered to supervise and regulate banks and other financial institutions. That’s why all money operators you choose and are going to integrate with, need to be allowed and licensed.

There is one more thing that is important to work thru, when you are going to develop a financial application and you work with personal sensitive data, you must be careful and meet all requirements to storage terms and conditions. Sensitive personally identifiable information (PII) – is information that, when disclosed, could result in harm to the individual whose privacy has been breached. For example, the most prominent federal privacy laws in the USA :

– The Federal Trade Commission Act

– The Financial Services Modernization Act

– The Fair Credit Reporting Act

– in Europe- General Data Protection Regulation.

And the last one, if you want to work with storage payment cards you need to follow Requirement 3 of the Payment Card Industry’s Data Security Standard (PCI DSS) to “protect stored cardholder data. “

Consequently, there are a lot of payment service operators, but when you dive into the process, you can find only a few services, which meet the business needs of your project.

Written by Oleksandra Denysenko and Viktoriya Fedyuk